kACE Gateway

Precision in every price

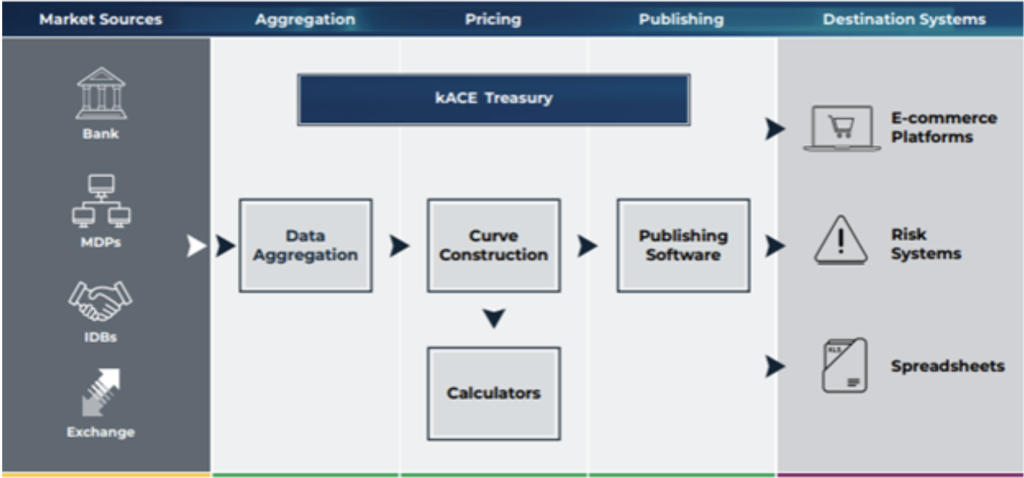

With over 30 years of experience, kACE Treasury FX delivers real-time, precision pricing across 60+ currencies and crosses. Whether you’re managing curve creation or optimizing trades, our scalable platform gives you the tools, data, and control you need—backed by trusted, high-quality derived pricing and built-in safeguards. Designed for financial institutions that demand speed, accuracy, and reliability – Power your FX Strategy with confidence.

Creating the primary FX forwards and NDF pricing source

The pricing engine allows for effective curve construction, using most liquid maturities and spreads with ability to add turns and events to curve ensuring accurate incremental pricing to your desk and e-commerce solutions.

- Supports “Step” interest rate curves for precise long-term FX forward pricing.

- Incorporates events and turns for more accurate pricing.

- Features include pips analysis, spot overrides, arbitrage tools, and CSA pricing.

- Odd-dated pricing, forward broken amounts, hedging calculators.

- Builds interest rate and NDF curves using futures, LIBOR, OIS, ARRs like SOFR.

- Provides consistency of data throughout the organisation.

- Aggregates standard pillar, IMM and turns data from multiple trusted sources where trader controls data sources.

- Automated data cleansing and outlier handling to ensure data integrity.

- Data sourcing via RTDS, B-PIPE and FIX enhances reliability.

- Power pricing in satellite applications, client screens and other destinations using kACE’s multiple publishing channels (FIX, TREP, Bloomberg).

- Open distribution channels by connecting to trading venues via the kACE FIX RFS API.

- Provide definable tier pricing for different client groups.

- Automatic withdrawal if prices break pre-set rules.

- Send prices with indicative, validated or tradable tags.

- Skew and spread individual targets, as groups or individual tenors.

- Scalable, high-performance system adaptable to institutional needs.

- Dynamic architecture handles market changes and system load via backpressure and conflation handling.

- Ensures system stability with validation and throttling mechanisms.

Where Market Data meets Intelligent Rate Construction

With over 30 years of experience, kACE Treasury FX delivers real-time, precision pricing across 60+ currencies and crosses. Whether you’re managing curve creation or optimizing trades, our scalable platform gives you the tools, data, and control you need—backed by trusted, high-quality derived pricing and built-in safeguards. Designed for financial institutions that demand speed, accuracy, and reliability – Power your FX Strategy with confidence.

The pricing engine allows for effective curve construction and supports 1m, 3m, 6m, 12m interest rate-based instruments, derived from fixings, volume weighted mid futures and/or FRAs, basis swaps and a variety of live interest rate instruments as appropriate.

- Futures prices calculated from bid/ask prices weighted by size interest and adjusted for futures convexity in real-time.

- Cross currency basis swaps and non-deliverable cross-currency basis swaps relating to the relevant choices of ARR’s or OIS for each currency in the currency pair.

- Provides consistency of data throughout the organisation.

Aggregating Data Sources & Quality Assurance

- Aggregates data from 15+ proprietary sources plus vendors (TREP, B-PIPE, FIX).

- Automated cleansing, outlier filtering, and data weighting.

- Allows live price overrides and time-based data controls.

- Real-time data delivery to trading, sales, e-commerce, and risk systems.

- Global/regional/local spread management available.

- Ability to skew and spread individual targets as groups or individual tenors.

- Curves publishable to middle-office systems.

- Full validation and flexible throttling of outgoing data to ensure downstream systems are not flooded.

- Built on robust, high-performance architecture.

- Rule-based price withdrawal and validation.

- Supports multiple publishing targets with flexible spread and skew controls.

- User-friendly dashboard for monitoring and throttling.

- Tools for pricing, risk assessment, and hedging (OIS, IRS, FRAs, Basis Swaps).

- Supports complex swaps and structures, including amortising and accreting swaps.

- Covers 30+ currencies with features like spread calculators and CSA pricing.

Latest News kACE